What Really Happens to Home Prices During a Recession?

Every time the word “recession” shows up in the news, it sparks concern—especially if you're thinking about buying or selling a home in Montgomery Alabama.

You might be asking:

-

Are home prices about to crash?

-

Will mortgage rates spike?

-

Should I hit pause on my plans?

Totally fair questions—and the good news is, history gives us real answers. Here’s what the data says and how it applies to the Montgomery real estate market in 2025.

A Recession Doesn’t Automatically Mean a Drop in Home Prices

Let’s start by clearing up one of the biggest myths out there:

A recession is not the same thing as a housing crash.

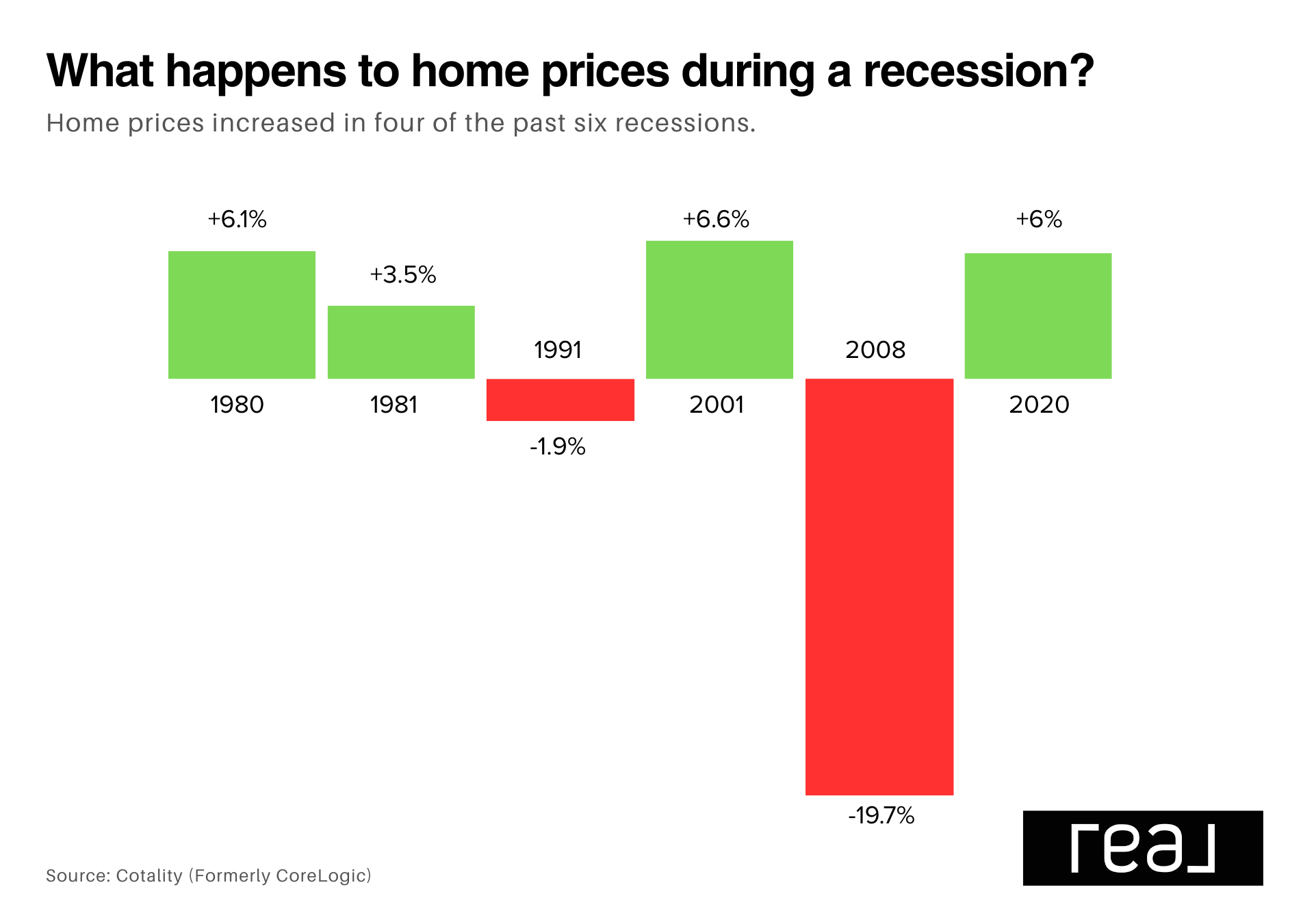

In fact, in 4 of the last 6 U.S. recessions, home prices actually increased. Only one recession saw a small drop of under 2%. The exception, of course, was 2008—a very specific and extreme situation driven by risky lending, overbuilding, and a fragile financial system.

Here’s what typically happens during a recession:

-

Home prices level off or rise modestly

-

Buyer activity might slow, but prices don’t usually collapse

-

Local market conditions, like inventory and demand, make a big difference

So for Montgomery Alabama real estate, where housing supply remains relatively tight, we’re unlikely to see prices fall dramatically—especially with steady local demand.

Mortgage Rates Tend to Drop During Recessions

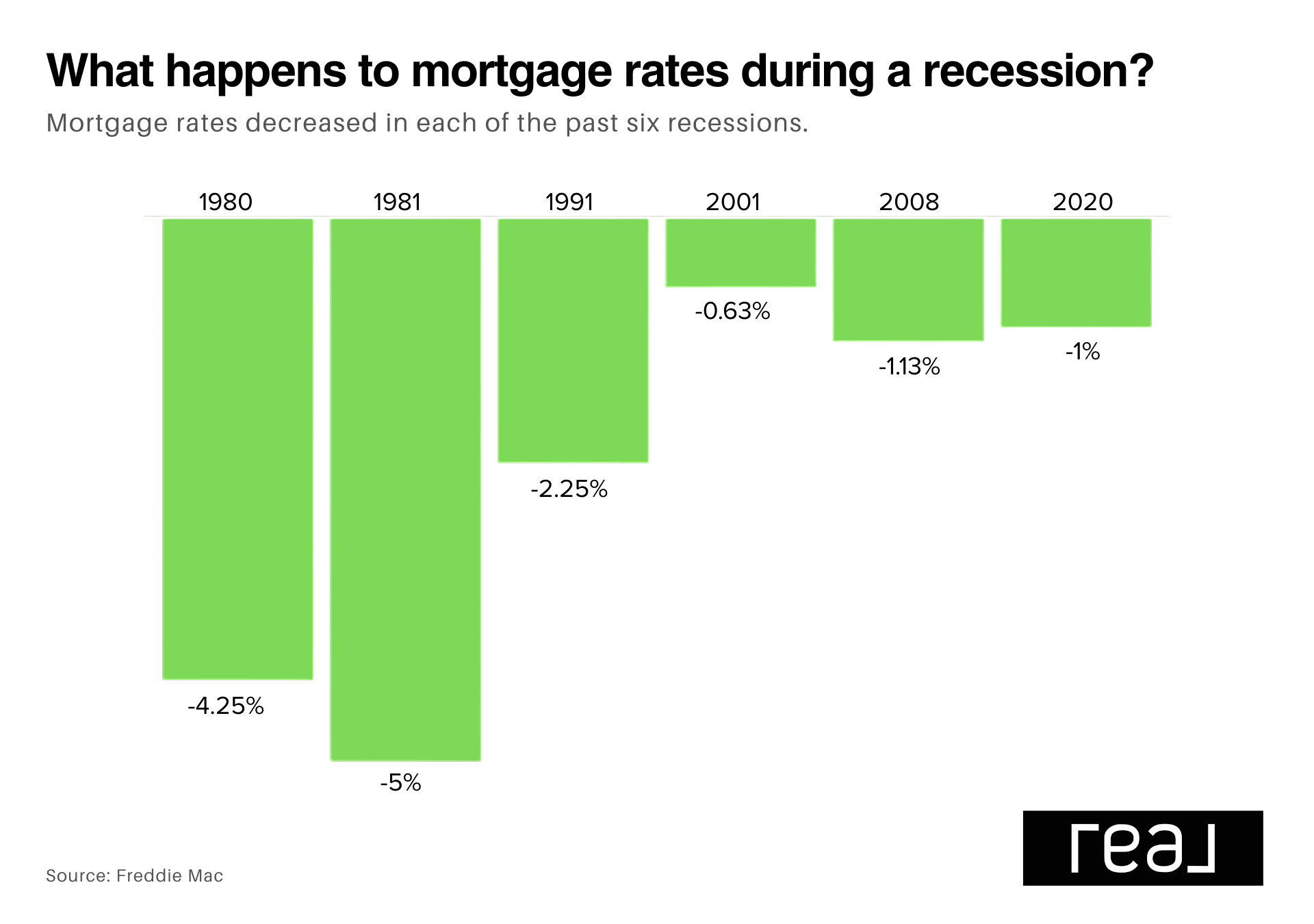

Now here’s a trend that buyers love to hear: mortgage rates usually fall during recessions.

According to data from Freddie Mac, rates declined in every U.S. recession over the past four decades. That’s because the Federal Reserve often lowers interest rates to stimulate the economy, and that trickles down to mortgage rates.

So while we probably won’t return to the record-low 3% rates of 2020, even a small drop can significantly lower your monthly payment.

For a Montgomery Alabama loan officer or buyer working with one, it’s worth watching rate trends closely—especially if you’ve been on the fence about purchasing.

Today’s Homeowners Have Strong Equity—Very Different from 2008

One of the biggest reasons we're unlikely to see a wave of distressed sales is because homeowners today are in a very strong financial position.

According to Realtor.com and Federal Reserve data:

-

Even with a 10% price drop, homeowners would still retain about 69.5% equity—similar to 2021 levels

-

A 20% drop would only take equity back to where it was in 2019

-

Over 54% of homeowners have mortgage rates below 4%, which means they’re in no rush to sell

In short, homeowners aren’t overleveraged—and that means price stability even in an economic slowdown.

What This Means for Buyers and Sellers in Montgomery Alabama

If you’re considering making a move in Montgomery, here’s the bottom line:

✅ Home prices aren’t expected to crash

✅ Mortgage rates are likely to ease, not spike

✅ Montgomery homeowners have strong equity, helping stabilize the market

That makes Montgomery Alabama real estate one of the more reliable investments, even during uncertain times. Whether you're buying or selling, working with an experienced Montgomery realtor can help you navigate your options with clarity and confidence.

Final Thoughts

Economic shifts will always cause concern—but the data tells a much more balanced story. If you're trying to decide whether to buy a home during a recession or wait, the right answer depends on your long-term goals—not fear.

If you’d like to talk about how today’s trends impact your situation, let’s connect. As your Montgomery Alabama realtor, I’m here to help you make informed, confident decisions—no matter what the headlines say.

Categories

- All Blogs (93)

- Living in Montgomery Alabama (45)

- Living in Pike Road Alabama (7)

- Living in Prattville Alabama (8)

- Living in Wetumpka Alabama (8)

- Montgomery Alabama Homes for Sale (16)

- Montgomery Alabama Real Estate (18)

- Pike Road AL Real Estate (1)

- Pike Road Homes for Sale (1)

- Prattville Alabama Homes for Sale (3)

- Prattville Alabama Real Estate (1)

- Real Estate Tips (51)

- Things to do in Montgomery Alabama (5)

- Things to do in Wetumpka Alabama (1)

- Wetumpka Alabama Homes for Sale (3)

- Wetumpka Alabama Real Estate (3)

Recent Posts